IEX Cloud Legacy API Docs

IEX Cloud Legacy is a platform that makes financial data and services accessible to everyone.

The IEX Cloud Legacy API is based on REST, has resource-oriented URLs, returns JSON-encoded responses, and returns standard HTTP response codes.

- The base url for the API is:

https://cloud.iexapis.com/ - We support JSONP for all endpoints.

Third Party Requirements

The following third parties require displaying attributions and copyrights for using their data.

CityFALCON

Intraday News endpoint, Historical News endpoint, and News stream endpoints provided by © City Falcon Limited.

If you use the Intraday News endpoint, Historical News endpoint, or News stream, you must display the following attribution and copyright:

Attribution: Powered by CityFALCON via IEX Cloud

Copyright: © City Falcon Limited

Invezz

The Intraday News endpoint data, Historical News endpoint data, and News stream endpoints data provided by Invezz (invezz.com).

If you use the Intraday News endpoint, Historical News endpoint, or News stream, you must display the following attribution and copyright:

Attribution: Invezz data provided by IEX Cloud

Copyright: invezz.com

KWhen

The Intraday News endpoint data, Historical News endpoint data, and News stream endpoints data provided by Kwhen Inc.

If you use the Intraday News endpoint, Historical News endpoint, or News stream, you must display the following attribution and copyright:

Attribution: Kwhen Finance provided by IEX Cloud

Copyright: Kwhen Inc.

New Constructs

Balance Sheet endpoint, Cash Flow endpoint, Fundamental Valuations endpoint, and Fundamentals endpoint provided by New Constructs, LLC © All rights reserved.

If you use data from the Balance Sheet endpoint, Cash Flow endpoint, Fundamental Valuations endpoint, or Fundamentals endpoint, you must display the following attribution and copyright:

Attribution: Data provided by New Constructs, LLC © All rights reserved.

Copyright: Data provided by New Constructs, LLC © All rights reserved.

Wall Street Horizon

Premium Data Deprecated is provided by Wall Street Horizon, Inc.

If you use Premium Data Deprecated, you must display the following attribution and copyright:

Attribution: Wall Street Horizon, Inc.

Copyright: Wall Street Horizon, Inc.

UTP Plan

Intraday Prices endpoint, Largest Trades endpoint, Quote endpoint, Collections endpoint, and U.S. Stocks SSE Streaming endpoints provided by UTP Plan (utpplan.com). Intraday Prices endpoint, Largest Trades endpoint, Quote endpoint, Collections endpoint, and U.S. Stocks SSE Streaming endpoints delayed 15 minutes.

Any access to Intraday Prices endpoint, Largest Trades endpoint, Quote endpoint, Collections endpoint, or U.S. Stocks SSE Streaming endpoints must be separately approved by the UTP Plan Administrator prior to the provision of Intraday Prices endpoint, Largest Trades endpoint, Quote endpoint, Collections endpoint, or U.S. Stocks SSE Streaming endpoints by IEX Cloud, including the completion of a Vendor Agreement with the UTP Plan.

Refinitiv

Analyst Recommendations endpoint Deprecated, Earnings endpoint Deprecated, Estimates endpoint Deprecated, and Price Target endpoint Deprecated provided by ©Refinitiv, 2018. All rights reserved. Use, duplication, or sale of this service, or data contained herein, except as described in the IEX Cloud Terms of Service is strictly prohibited. The Refinitiv Kinesis Logo and Refinitiv are trademarks of Refinitiv and its affiliated companies in the United States and other countries and used herein under license.

Copyright © 2018, Refinitiv. All rights reserved. Refinitiv Holdings Limited (“Refinitiv”) and its affiliates are referred to below as “Refinitiv”.

The “Information Product” is any data or service provided by Refinitiv. Refinitiv or its third party providers own and retain all rights, title and interest, including but not limited to copyright, trademarks, patents, database rights, trade secrets, know-how, and all other intellectual property rights or forms of protection of similar nature or having equivalent effect, anywhere in the world, in the Information Product and user is not granted any proprietary interest therein or thereto. The Information Product constitutes confidential and trade secrets of Refinitiv or its third party providers. Display, performance, reproduction, distribution of, or creation of derivative works or improvements from Information Product in any form or manner is expressly prohibited, except to the extent expressly permitted hereunder, or otherwise, with the prior written permission of Refinitiv.

User may use the Information Product for internal purposes only. User may copy, paste and distribute internally only an insubstantial amount of the data contained in the Information Product provided that: (a) the distribution is incidental to or supports user’s business purpose; (b) the data is not distributed by user in connection with information vending or commercial publishing (in any manner or format whatsoever), not reproduced through the press or mass media or on the Internet; and © where practicable, clearly identifies Refinitiv or its third party providers as the source of the data. Data will be considered in “insubstantial amount” if such amount (a) has no independent commercial value; or (b) could not be used by the recipient as a substitute for any product or service (including any download service) provided by Refinitiv or a substantial part of it.

To the extent that the Information Product contains any third party data referred to in the General Restrictions/Notices page set forth on http://www.thomsonreuters.com/datause, the terms set forth on such General Restrictions/Notices page shall apply to user.

User acknowledges that access tocertain elements of the Information Product may cease or may be made subject to certain conditions by Refinitiv or upon the instructions of the third party provider of those elements. Upon termination or expiration of this user license, all rights granted hereunder shall immediately terminate and user shall cease to use the Information Product and delete or destroy all copies thereof in its possession or control.

NEITHER REFINITIV NOR ITS THIRD PARTY PROVIDERS WARRANT THAT THE PROVISION OF THE INFORMATION PRODUCT WILL BE UNINTERRUPTED, ERROR FREE, TIMELY, COMPLETE OR ACCURATE, NOR DO THEY MAKE ANY WARRANTIES AS TO THE RESULTS TO BE OBTAINED FROM USE OF THE SAME. USE OF THE INFORMATION PRODUCT AND RELIANCE THEREON IS AT USER’S SOLE RISK. NEITHER REFINITIV OR ITS THIRD PARTY PROVIDERS WILL IN ANY WAY BE LIABLE TO USER OR ANY OTHER ENTITY OR PERSON FOR THEIR INABILITY TO USE THE INFORMATION PRODUCT, OR FOR ANY INACCURACIES, ERRORS, OMISSIONS, DELAYS, COMPUTER VIRUS OR OTHER INFIRMITY OR CORRUPTION, DAMAGES, CLAIMS, LIABILITIES OR LOSSES, REGARDLESS OF CAUSE, IN OR ARISING FROM THE USE OF THE INFORMATION PRODUCT. THE INFORMATION PRODUCT IS PROVIDED ON AN “AS IS” BASIS AND WITHOUT WARRANTY OF ANY KIND. NO WARRANTIES EITHER EXPRESSED OR IMPLIED, INCLUDING BUT NOT LIMITED TO ANY IMPLIED WARRANTY OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, TITLE, INFRINGEMENT OR OTHERWISE IS PROVIDED HEREUNDER.

IN NO EVENT WILL REFINITIV OR ITS THIRD PARTY PROVIDERS BE LIABLE FOR ANY DAMAGES, INCLUDING WITHOUT LIMITATION DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES, LOSSES OR EXPENSES ARISING IN CONNECTION WITH INFORMATION PRODUCT EVEN IF REFINITIV OR ITS THIRD PARTY PROVIDERS OR THEIR REPRESENTATIVES ARE ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES. FURTHER, REFINITIV OR ITS PARTY PROVIDERS SHALL NOT BE LIABLE IN ANY MANNER FOR REDISTRIBUTOR’S PRODUCTS OR SERVICES.

API Versioning

IEX Cloud will release new versions of the API when we make backwards-incompatible changes. We plan to support up to three active versions and will give advanced notice before releasing a new version or retiring an old version.

Backwards compatible changes:

- Adding new response attributes

- Adding new endpoints

- Adding new methods to an existing endpoint

- Adding new query string parameters

- Adding new path parameters

- Adding new webhook events

- Adding new streaming endpoints

- Changing the order of existing response attributes

Current Version is v1

Naming Convention

stable can be used to access the latest stable API version.

beta can be used to access the latest API version.

Endpoint Versioning

Endpoints may be in various states of alpha, beta, deprecated, etc. These indicate that an endpoint is either not yet subject to the requirements above (in the case of alpha, beta) or that it will be modified within the same API version (in the case of deprecated).

Deprecation

Both the IEX Cloud platform and the financial data ecosystem are constantly evolving. Occasionally, it may become necessary to deprecate specific features, including endpoints. Events that may necessitate feature deprecation include, but are not limited to, data contract changes, critical usability issues, and data universe expansion. We publish new feature deprecations in the Changelog and in each feature’s documentation as soon as possible.

In case of impending data feature removals, we make every effort to provide alternative access to underlying data or access to another provider’s data, and maintain respective deprecated endpoints for a reasonable timeframe.

Attribution

Attribution is required for all users. It is as simple as putting “Data provided by IEX Cloud” somewhere on your site or app and linking that text to https://iexcloud.io. In case of limited screen space, or design constraints, the attribution link can be included in your terms of service.

<a href="https://iexcloud.io">Data provided by IEX Cloud</a>

When displaying a real-time price, you must display and link to IEX Cloud as the source near the price. The link is commonly placed below the price.

<a href="https://iexcloud.io">IEX Cloud</a>

Authentication

API Tokens

IEX Cloud authenticates your API requests using your account’s API tokens. To use any IEX Cloud API, you must pass an API token with each request. If you do not include your API token when making an API request, or use one that is incorrect or disabled, IEX Cloud returns an error.

IEX Cloud provides two types of API tokens: publishable and secret.

Publishable API tokens are meant solely to identify your account with IEX Cloud, they aren’t secret. They can be published in places like your website JavaScript code, or in an iPhone or Android app.

Secret API tokens should be kept confidential and only stored on your own servers. Your account’s secret API token can perform any API request to IEX Cloud.

Protecting Your API Tokens

- Keep your secret token safe. Your secret token can make any API call on behalf of your account, including changes that may impact billing such as enabling pay-as-you-go charges. Do not store your secret token in your version control system. Do not use your secret token outside your web server, such as a browser, mobile app, or distributed file.

- Monitor usage of your API for anomalies. If you observe unauthorized or abnormal usage, rotate your API token. IEX Cloud provides multiple options to address abnormal usage. ..* You may use the IEX Cloud console to rotate an API token. Rotating a token will disable access to IEX Cloud for the rotated token within 10 seconds. ..* You may use the IEX Cloud API or console to disable pay-as-you-go. This may prevent unexpected charges due to unauthorized or abnormal usage.

- Do not embed API keys directly in code. Instead of directly embedding API keys in your application’s code, put them in environment variables or in include files that are stored separately from the bulk of your code—outside the source repository of your application. Then, if you share your code, the API keys will not be included in the shared files.

- Do not store API tokens in inside your application’s source control. If you store API tokens in files, keep the files outside your application’s source control system. This is particularly important if you use a public source code management system such as GitHub.

- Limit access with restricted tokens. IEX Cloud console will allow you to specify the IP addresses or referrer URLs associated with each token, reducing the impact of a compromised API token.

- Use independent API tokens for different apps. This limits the scope of each token. If an API token is compromised, you can rotate the impacted token without impacting other API tokens.

Error Codes

IEX Cloud uses HTTP response codes to indicate the success or failure of an API request.

General HTML status codes

2xx Success.

4xx Errors based on information provided in the request

5xx Errors on IEX Cloud servers

IEX Cloud HTTP Status Codes

| HTTP Code | Type | Description |

|---|---|---|

| 400 | Incorrect Values | Invalid values were supplied for the API request |

| 400 | No Symbol | No symbol provided |

| 400 | Type Required | Batch request types parameter requires a valid value |

| 401 | Authorization Restricted | Hashed token authorization is restricted |

| 401 | Authorization Required | Hashed token authorization is required |

| 401 | Restricted | The requested data is marked restricted and the account does not have access. |

| 401 | No Key | An API key is required to access the requested endpoint. |

| 401 | Secret Key Required | The secret key is required to access to requested endpoint. |

| 401 | Denied Referer | The referer in the request header is not allowed due to API token domain restrictions. |

| 402 | Over Limit | You have exceeded your allotted credit quota (and pay-as-you-go is not enabled on legacy plans). |

| 402 | Free Tier Not Allowed | The requested endpoint is not available to free accounts. |

| 402 | Tier Not Allowed | The requested data is not available to your current tier. |

| 403 | Authorization Invalid | Hashed token authorization is invalid. |

| 403 | Disabled Key | The provided API token has been disabled |

| 403 | Invalid Key | The provided API token is not valid. |

| 403 | Test Token in Production | A test token was used for a production endpoint. |

| 403 | Production Token in Sandbox | A production token was used for a sandbox endpoint. |

| 403 | Circuit Breaker | Your pay-as-you-go circuit breaker has been engaged and further requests are not allowed. |

| 403 | Inactive | Your account is currently inactive. |

| 404 | Unknown Symbol | Unknown symbol provided |

| 404 | Not Found | Resource not found |

| 413 | Max Types | Maximum number of types values provided in a batch request. |

| 429 | Too Many Requests | Too many requests hit the API too quickly. An exponential backoff of your requests is recommended. |

| 451 | Enterprise Permission Required | The requested data requires additional permission to access. |

| 500 | System Error | Something went wrong on an IEX Cloud server. |

Security

We provide a valid, signed certificate for our API methods. Be sure your connection library supports HTTPS with the SNI extension.

Request Limits

Each IEX Cloud Plan has a request rate limit. Limits are applied to each organization.

Requests per Second Limits

| Legacy Plan | Requests Per Second Limit |

|---|---|

| Start | 5 |

| Launch | 5 |

| Individual | 5 |

| Grow | 200 |

| Scale | 200 |

| Business | 200 |

We do allow bursts, but the Scale/Grow/Business allowance should be sufficient for almost all use cases.

Note that Sandbox Testing has a request limit of 5 requests per second, measured in milliseconds.

SSE endpoints are limited to 50 symbols per connection. You can make multiple connections if you need to consume more than 50 symbols.

Credits and Pricing

Credit Basics

Every dataset has an associated cost in credits based on:

- How much data is there? A dataset like

Fundamentalsincludes hundreds of fields, while a singleUS Treasury Yieldrecord might only have one field. - How frequently does the data update?

Quoteupdates millions of times per day, whileUnemployment Ratemight only update weekly - How much does it cost to acquire the data? Some datasets we collect on our own, other datasets we purchase from upstream vendors. Ingesting and normalizing data has infrastructural costs on top of the base dataset cost.

- How much does it cost to distribute the data? With billions of API calls and bursty workloads around market hours, our infrastructure needs to scale up and down to ensure constant uptime and consistent delivery.

We call this associated credit cost the dataset’s weight. When you access a dataset, the total weight charged for the access will generally be the weight multiplied by the number of records received (taking into account the other possible credits or debits below). If you don’t receive any records, you won’t be charged for accessing that dataset. Each endpoint has its own weight which you can find in the documentation below. If the sum of these charges exceeds your monthly credit allocation, you will need to upgrade or purchase additional packages to continue accessing data.

Credit allocations reset on the first of each month at 00:00:00 UTC. API calls will return iexcloud-credits-used in the header to indicate the total number of credits consumed for the call, as well as an iexcloud-premium-credits-used to indicate the total number of premium credits consumed for the call. You can also track this information in the console.

Other credits and debits

API Use

All API calls will have an additional 1 credit access charge. This allows us to keep data costs lower across a wide variety of datasets. The following endpoints are omitted:

- Account endpoints

- Status endpoints

- Timeseries Metadata and Inventory endpoints

- Files inventory endpoints

- Data points inventory endpoints

- Calls that result in 4XX or 5XX error codes

SSE connections will have a 1 credit charge on initial connection, not per record. Batch calls will have an additional 1 credit charge for the entire batch, regardless of the number of symbols or channels contained in the batch.

Legacy Individual Plans and Business Plans

Included with Individual plans ($9 per month with an annual subscription, or $19 per month with a monthly subscription):

- Five credits per month.

- One API token.

- One user login.

- Both commercial and personal use.

Included with Business plans ($199 per month with an annual subscription, or $299 per month with a monthly subscription):

- 150 credits per month.

- Four API tokens.

- Four user logins.

- Full feature access – everything included with Individual plus more. More detail coming soon.

- Both commercial and personal use.

Both plans provide the following:

Credits (previously called messages): Use credits to make more API calls and request more data from IEX Cloud.

Tokens: Tokens connect your project or application to your account. You can track, control, and throttle data usage by token. Examples of when you’ll use multiple tokens include using IEX Cloud to support multiple applications, projects, teams, or user accounts. For instance, if you support three applications, you would likely use a different token for each app.

User logins: Adding user logins to your plan adds room for more teammates to join your IEX Cloud account and use its data.

If you need to add more credits, API tokens, or user logins to your account, you can upgrade your plan or add packages.

Credits in Legacy Plans

Credits are the fundamental units used to access data and make API calls on IEX Cloud legacy plans. Each API endpoint has a certain “data weight,” or a given number of credits that are used every time you make an API call with that endpoint.

For example, the Earnings endpoint has a data weight of 1,000 credits per symbol per period. This means you would use 1,000 credits to see a company’s earnings for one specific quarter.

Credits make your legacy subscription with IEX Cloud flexible and adjustable to your use case. You may use a higher volume of lower-weighted endpoints, fewer higher-weighted endpoints, or a combination. Note that certain endpoints are only available with paid legacy plans on IEX Cloud.

The IEX Cloud Console Credits → Credit Use tab automatically keeps track of how many credits you have used so far in the month. Note to the data weights for different endpoints on IEX Cloud.

Why do different API endpoints use different numbers of credits?

Data weights are determined by a number of factors, including agreements between IEX Cloud and our third-party data providers, the cost of sourcing the data further upstream, and other computational costs.

Rather than requiring customers to pay for a preset selection of data in bulk, credits give you the flexibility to choose exactly the data you want to use with your subscription and how often you want to use it. IEX Cloud serves a diverse range of use cases and is designed to make data accessible for everyone.

How many credits do I need, and which plan should I choose?

Each IEX Cloud legacy plan provides a different monthly allocation of credits, tokens for connecting your applications to your account, and user logins. The different plans also come with a designated set of tools and available datasets, which you can see on our pricing page.

You can choose your plan based on your use case:

- The legacy Individual plan: This plan is ideal for personal use, projects, students, building basic applications, testing, freelancers, and light use.

- The legacy Business plan: This plan allows for more scale and flexibility for growing technology companies and larger enterprises. With more credits, tokens, and user logins, it’s built to help growing businesses scale, bring flexibility to how firms build and make it easier to integrate IEX Cloud into your team’s workflow.

In addition to choosing your base plan, you can also further customize it by adding packages. Packages add credits for more data usage, tokens for connecting more apps to your account, and user logins.

To help choose your plan and how many packages you need, it can be helpful to estimate how many credits you’ll need on a monthly basis. Once you know what data you would like to use on IEX Cloud, you can estimate your monthly credit usage by referencing those endpoints’ data weights in our documentation and multiplying that weighting by how frequently you will request this data.

Our calculator here can help assist with a rough estimation. Alternatively, use the following formula as a guideline:

Data Weight x Number of Symbols x Frequency = Credit Use for that API Endpoint

For example, let’s say you were looking to see the last three quarters’ earnings for a list of 5,000 companies. The Earnings endpoint uses 1,000 credits per symbol per period.

Your credit usage for that endpoint would be:

(1,000 credits) x (5,000 symbols) x (3 periods) x (1 call per symbol) = 15,000,000 credits

Core credits vs. Pay-as-you-go Credits (For legacy Launch, Grow, and Scale plans only)

On our legacy plans, each IEX Cloud plan provides a different number of monthly core credits, as well as different pay-as-you-go credits.

Core credits represent the base number of credits included with your subscription each month. Core credits can be used towards any of the Core Data endpoints included with your plan. Your core credit usage is reset at the beginning of each calendar month.

Pay-as-you-go credits can be used in addition to your core credits as needed and are priced at a discounted rate. After you’ve used your core credits for a given month, you can use pay-as-you-go credits to continue accessing as much data as you need. With legacy Launch, Grow, and Scale plans, pay-as-you-go credits can also be used to access Premium Data — specialized datasets that can be added onto your subscription.

It’s recommended that you enable the automatic use of pay-as-you-go credits in the IEX Cloud Console. This setting helps prevent disruption in your service and allows IEX Cloud to default over to using pay-as-you-go credits after you have used all of your core credits for the month.

If you do not have the automatic use of pay-as-you-go credits enabled, IEX Cloud will pause access to data after you have used all of your core credits and will restore access at the beginning of the next month.

Best practices for credits

Make the most of your credits by checking out these IEX Cloud features:

- Packages (for Individual and Business plans only): If you need more credits with your Individual and Business plans, you can simply add packages. Learn more about packages. Decide on an appropriate history and update interval. For example, if I want to access 5 years of financial statements, I do not need to purchase a plan that allows me to access 5 years of financial statements each month. I can simply purchase enough packages to backfill 5 years once, then reduce my packages to maintain ongoing updates. You can also leverage APIs like data points to check when data has been updated.

- Pay-as-you-go credits (for legacy Launch, Grow, and Scale plans only): Enable pay-as-you-go credits in the IEX Cloud Console. This ensures that you can continue to access data without interruption if you use all the core credits allocated with your subscription for the month.

Budgeting Credit Usage

Some legacy Launch, legacy Grow, and legacy Scale plans still support the pay-as-you-go credits billing method. That is you can pay as you go for either Premium Data usage or for overages if you use more credits in a given month than allocated with your plan.

Since pay-as-you-go credits are not prepaid (and you can consume as many as you want on top of your plan), many users prefer to set a limit inside of their IEX Cloud Console to prevent accidental runaway usage.

If you have pay-as-you-go, you can also set a “credit budget” for both core data usage and Premium Data usage. To set up, navigate to the Credit Use tab in the IEX Cloud Console and click at the top to either “Core Use” or “Premium Use.”

Under the month’s usage chart, you can set your budget.

Premium Data credit budgets

If you are on a legacy Launch, Grow, and Scale plan, a default budget of 100,000,000 credits was set when you enable access to your first dataset. When this limit is reached, access to Premium Data will be paused until the end of the month or until the limit is modified. You can change this limit at any time in the IEX Cloud Console.

Questions? Let us know at support@iexcloud.io

Legacy Packages

Packages make it easier to customize your IEX Cloud plan according to your use case so that your plan scales with you as you grow. You can add packages as you need them throughout your legacy plan term.

Add packages to your plan to receive more of the following:

- Credits (previously called messages) – Included in packages for both legacy Individual and legacy Business plans: Use credits to make more API calls and request more data from IEX Cloud.

- Tokens – Included in packages for Business plans: Tokens connect your project or application to your account. You can track, control, and throttle data usage by the token. Examples of when you’ll use multiple tokens include using IEX Cloud to support multiple applications, projects, teams, or user accounts. For instance, if you support three applications, you would likely use a different token for each app. Learn more about tokens.

- User logins – Included in packages for legaycy Business plans: The number of user logins on your plan refers to the number of seats you have for teammates to log into your IEX Cloud account. Adding user logins to your plan adds room for more people to join your IEX Cloud account and use its data.

You can both add and remove packages from your legacy plan as you need. Once you add a package, by default it will be added to your plan for each subsequent month. If you remove a package from your plan, it expires at the end of the current month. Packages can be removed or added month to month for both monthly and annual plans.

Packages cannot be added to free legacy Start plans or to legacy Launch, Grow, and Scale plans. To use packages, you must have the legacy Individual plan or legacy Business plan.

What is included with each package?

Packages are different depending on your paid plan, and can only be added to legacy Individual plans or legacy Business plans.

Legacy Individual plan ($10 per month per package - for both monthly and annual plans) – each package includes every package adds:

- 10 credits to your account.

Legacy Business plan ($30 per month per package - for both monthly and annual plans) – every package adds:

- 30 credits.

- One token.

- One user login – or additional login for a teammate on your IEX Cloud account.

How do I add more packages to my legacy plan, and when should I add them?

How many packages you need depends on how many credits, tokens, or seats for users you need. You can always add more packages to your plan as you go, or purchase multiple packages up front.

To add packages, manage your plan in the Console or contact Support. You might add more packages if:

- You need additional credits. With the new pricing plans, we replaced pay-as-you-go overages with packages. If you approach your plan’s credit (or message) limits, you can either upgrade your plan or purchase additional packages. We will notify you via email when you reach your credit limits with instructions on how to add packages to your plan.

- You need more tokens added to your account. Depending on your use case, you may need additional tokens for your account. For instance, if you have multiple teams or applications, you will likely need multiple tokens for each of those teams or apps.

- You need to add more user logins to your account. Maybe you’re expanding your team, or a new team at your business wants to join your IEX Cloud account to start a new project.

To see your current credit and plan usage, log into the IEX Cloud Console and go to Credits → Credit Use.

Packages are only available with the legacy Individual and Business plans, and cannot be added to legacy Launch, Grow, or Scale plans. If you already have a paid Launch, Grow, or Scale plan.

How do overages work with the new plans?

IEX Cloud users on legacy Launch, Grow, or Scale plans will be familiar with the concept of pay-as-you-go messages (now pay-as-you-go credits). Instead of paying overages this way at the end of each month using pay-as-you-go credits, to use additional credits with these pricing plans, you’ll purchase packages.

We replaced overages with packages based on user feedback, with the goal of providing a simpler, more transparent way of scaling your plan with your usage.

If you reach your plan’s monthly credit limits, we will notify you via email with instructions on how to add packages to your plan. To prevent disruption, we suggest periodically checking your credit usage in the Console as well as purchasing packages in advance if you anticipate needing to use additional credits. When you reach your monthly credit limit, access to data will be temporarily paused until more credits are added to your plan or the next month begins.

How are packages billed?

For both monthly and annual plans, packages are billed immediately upon purchase for the current month. They are then billed on the 1st{sup}** of each subsequent month. For instance, let’s say you purchase a package with your annual Business plan on the 16th. You’ll pay $30 upon purchase, and then $30 on the 1st of each subsequent month.

If you remove your package in the middle of a month, you’ll have it for the remainder of the month, after which it expires and you’ll no longer be charged for that package.

{sup}** IEX Cloud billing utilizes Universal Time Coordinated (UTC). Renewals will occur at 00:00 UTC (08:00 PM EST).

Legacy Premium Data

IEX Cloud paid legacy plans include a breadth of data through a single easy-to-use API - ranging from simple stock prices for everyday investing to Premium Data for more specialized use.

This guide provides more detail on how Premium Data differs from Core Data and how to get started.

Core Data vs. Premium Data

Core Data is the data included with IEX Cloud subscriptions. This includes any endpoints listed outside of the Premium Data section, such as stock data, FX data, macroeconomic data, and more. The credits allocated with the IEX Cloud subscription can be used towards Core Data only.

Premium Data is specialized data made available through the IEX Cloud API, sourced from various Data Partners directly. Premium Data consumption is on a pay-as-you-go basis using Premium Data credits, with different credit weights for each specific dataset. Premium Data is only included in paid IEX Cloud legacy subscriptions.

Premium Data is available to customers with a paid legacy plan on IEX Cloud.

How do I start using Premium Data?

Follow the steps below to access Premium Data:

- Add Premium Data credits to your account on the add-ons page. Premium Data usage is purchased with prepaid Premium Data credits.

Request access to data on the Premium Data page of the IEX Cloud Console. For many datasets, you’ll be granted access right away. However, a couple requires partner approval and it could be a few business days before your access is activated. You can request access here.

Once the Data Partner that provides that dataset confirms your request, it will be marked as “Enabled.“

Start accessing data! Your account will then be able to successfully make API requests to the dataset’s endpoints. You can start and stop using Premium Data at any time.

Be sure to check Premium Dataset endpoints’ data weights before use. The endpoints for Premium Data and their weighting are documented.

Please note that each Data Partner has its own unique protocol for processing data access requests. You may be asked to complete a couple of extra steps or experience wait times when confirming access for different datasets.

Pricing for Premium Data on IEX Cloud

Premium Data is available as an addition to the Core Data already accessible through the IEX Cloud paid legacy subscriptions and uses Premium Data credits. For legacy Launch, Grow, and Scale plan users, it also uses pay-as-you-go credits. Credits included with the IEX Cloud subscriptions are used for Core Data and cannot be used towards Premium Data.

Premium Data makes it easy to access a wider range of financial data and alternative data all in one place. Premium Data may be priced higher than other endpoints used as a part of the IEX Cloud Core Data offering, as it provides curated, specialized data sourced directly from other data creators.

How much data usage do I get with each dollar of Premium Data credits?

When you purchase Premium Data credits, you’ll notice that you purchase in dollar amounts. Our Premium Data endpoints, on the other hand, are priced in credits. For instance – you might purchase $50 worth of Premium Data credits, with the plan of using a Premium Data endpoint with a data weight of 100,000 credits per API call.

For our Business and Individual legacy plans, you purchase credits for Premium Data use at $1 per 1 credit. For instance, $20 would provide 20,000,000 credits.

For our legacy plans, the dollar-to-credit conversion depends on your plan. Premium Data is charged at the cost of your pay-as-you-go credit rate:

- Launch: $1 per 1 credit

- Grow: $1 per 2 credits

- Scale: $1 per 3 credits

What is the monthly credit budget on Premium Data use? (Legacy Launch, Grow, and Scale plans only)

Credit budgets are the same as message budgets.

With legacy Launch, Grow, and Scale plans that use pay-as-you-go credits, IEX Cloud allows you to set customizable limits for the number of credits used on Premium Data per month. Credit budgets can be used to help maintain a cap on your credits consumption for the month or prevent accidental runaway use of Premium Data.

A default budget of 100,000,000 credits is set when you enable access to your first dataset. When this limit is reached, access to Premium Data will be paused until the end of the month or until the limit is modified. You can change this limit at any time in the IEX Cloud Console.

Other Premium Data FAQs

What Premium Data is currently available?

You can see a full list of available Premium Data in the IEX Cloud Console under the Premium Data tab.

If there is certain data you would like to access that is not currently offered, please reach out to support@iexcloud.io with your request. Your feedback is essential to our future product roadmap.

Can I test Premium Data with IEX Cloud’s sandbox (deprecated)?

You can test Premium Data using IEX Cloud’s sandbox (deprecated), regardless of whether you have enabled access to that dataset. IEX Cloud’s sandbox provides scrambled test data and does not charge for any credits.

Prepaying for Premium Data with Premium Data Credits

Premium Data credits are a payment method on IEX Cloud where you purchase Premium Data usage upfront in bulk. You can choose how much you purchase in advance based on your anticipated usage of Premium Data, and add more Premium Data credits as you go.

For Individual and Business legacy plans, Premium Data credits are the only payment method for Premium Data.

For other legacy plans, you also have the option of using our legacy pay-as-you-go credits to purchase Premium Data. The legacy Launch, Grow, and Scale plans will allow you to use a certain number of pay-as-you-go credits every month for purchasing Premium Data. For usage beyond that amount, you will need to use prepaid Premium Data credits as your payment method.

How do I purchase Premium Data credits?

To view the Premium Data credits option, you must be logged in as an account admin. Navigate to the Add Ons tab of the IEX Cloud Console. You can select how much credit you would like to purchase, with a $20 minimum. There is no limit on how many Premium Data credit packages that can be purchased at a time. After you complete your purchase, Premium Data credits will be valid for one year.

Note that Premium Data credits are available for use after purchase beginning the first day of the upcoming month. For instance, if you purchased $200 worth of Premium Data credits on April 15th, 2020, this credit would be applied to your account and available starting May 1st, 2020 – the first day of the upcoming month – and would be available for use until May 1st, 2021.

Premium Data credits are available with IEX Cloud paid legacy plans only.

When can I apply my Premium Data credits?

Premium Data credits can be applied towards Premium Data only, and cannot be used towards your Core Data subscription or add-ons, except from widgets (deprecated). Premium Data credits can be used for up to 12 months from the time of purchase.

For instance, if you purchase Premium Data credits on March 1st, 2020, they will expire after March 1st, 2021. Note that unused credits cannot be returned as a refund.

Where can I see how much credit I have remaining?

After you purchase Premium Data credits in the Add Ons tab, you can track how much credit you have remaining in the Premium Data usage dashboard.

Premium Data credits vs. pay-as-you-go credits (For legacy Launch, Grow, and Scale plans only)

For our legacy Launch, Grow, and Scale plans, there are two methods for purchasing Premium Data: Premium Data credits and pay-as-you-go credits.

Premium Data credits can be used towards Premium Data only – credits can be purchased in advance in bulk, rather than paying for Premium Data as you use it. You can choose how much you would like to purchase upfront based on your expected usage of Premium Data. After purchasing Premium Data credits, that balance will be applied to your Premium Data usage for the next 12 months.

You can also pay for Premium Data as you need it using pay-as-you-go credits. Pay-as-you-go credit usage is billed at the end of each month. For each subscription tier, there is a limit for how many pay-as-you-go credits you can use in a month. Consuming credits beyond this monthly limit will require that you purchase prepaid premium data credits. Learn more about pay-as-you-go credits here.

When do I need to use Premium Data credits? (For legacy Launch, Grow, and Scale plans only)

Depending on your plan and the amount of Premium Data usage, Premium Data credits may be the required payment method. For each subscription tier, there is a monthly limit on how many pay-as-you-go credits you can use for Premium Data. To continue using Premium Data after that limit, you will need to purchase Premium Data credits. Those pay-as-you-go limits are outlined below:

- Launch: 50 pay-as-you-go credits per month (equivalent to $50 at $1/1 credit)

- Grow: 100 pay-as-you-go credits per month (equivalent to $50 at $½ credits)

- Scale: 3 pay-as-you-go credits per month (equivalent to $1,000 at $1/3 credits)

If you have not reached any of the limits above, and you use all your Premium Data credits, pay-as-you-go credits will automatically be used for additional Premium Data usage. If you want to prevent IEX Cloud from automatically using pay-as-you-go credits, you can enable a monthly credit budget. You can also purchase additional Premium Data Credits at any time.

Caching Data in Legacy Plans

Setting up your own caching

Legacy Individual and legacy Business plan users, as well as legacy Launch, Grow, and Scale subscribers are permitted to cache data on their own servers and can then display data from the cache to their users for commercial use.

Please note that you cannot provide IEX Cloud data via your own API to users or provide a mechanism for mass downloads, including a CSV download. Read more about acceptable usage of the platform in our Terms of Service.

One Additional Credit Used Per API Call

Starting July 15, 2021, each API call uses one additional credit on top of the endpoint’s data weight.

For instance, if the data weight for an endpoint is 100 credits per request, each API call would use a total of 101 credits. Or if you’re using free real-time stock prices from IEX, you would use a total of one credit per API call.

If you’re streaming data, you would use one additional credit per connection.

This applies to all production API calls (API calls not made in our Sandbox environment).

Why is one extra credit used per API call?

This one-credit covers our operational costs for delivering data and enables us to keep the costs lower across dozens of endpoints. This also allows us to continue investing in scalable infrastructure.

For most users, this adds minimal cost – a few cents to a few dollars per month in usage. For instance, if you make one million API calls per month, this update would add roughly $1 per month in credit usage.

What about sandbox API calls?

Sandbox API calls are free and unlimited and do not use any of your monthly credit allocations.

Sandbox API calls can also be used to help show how many credits would be used if that same API call were performed in the production. You’ll see this one credit reflected in “sandbox data weight” that’s returned in the API request’s response header to help you accurately estimate how many credits you would use.

Does this apply to Premium Data and other add-ons?

Every production API call across the platform will use one additional credit. This includes:

- Core Data and Reference Data.

- Premium Data. (The additional credit used will be a core credit, rather than a Premium Data credit.)

- Add-ons such as the Excel plug-in and Stock Price Widgets.

This does NOT include:

- Every SSE streaming or Firehose update. Streaming will use one additional credit per connection made – not per update.

- Sandbox API calls (deprecated).

Legacy Plan Cost for Stock Price Data

The Quote and Intraday Prices endpoints are available with free legacy plans, although specific fields – such as 15 minute delayed data – require a paid legacy plan. Without a paid legacy plan, those fields return null. For both legacy free and legacy paid users, the use of these endpoints requires credits (previously called messages).

Furthermore, 15 minute delayed price data for Nasdaq-listed securities also requires UTP authorization.

The Quote endpoint uses one credit per update per symbol. Similarly, the Intraday Prices endpoint uses one credit per update per symbol per interval – for instance, you might request minute-by-minute data for 30 minutes in one API call, which would use 30 credits.

The Intraday Prices endpoint only charges you a maximum of 50 credits per update per symbol if you are querying for multiple-minute time intervals. For instance, if you request 90 minutes of data, while this would be 60 intervals, you are charged only 50 credits.

Note that data provided by the Investors Exchange via the IEX Cloud API, including the real-time IEX prices, is free for use. You can access this using our TOPS endpoint (coming soon). You can also apply the chartIEXOnly parameter to the Intraday Prices endpoint to access IEX-only minute-by-minute data from the current trading day free of charge.

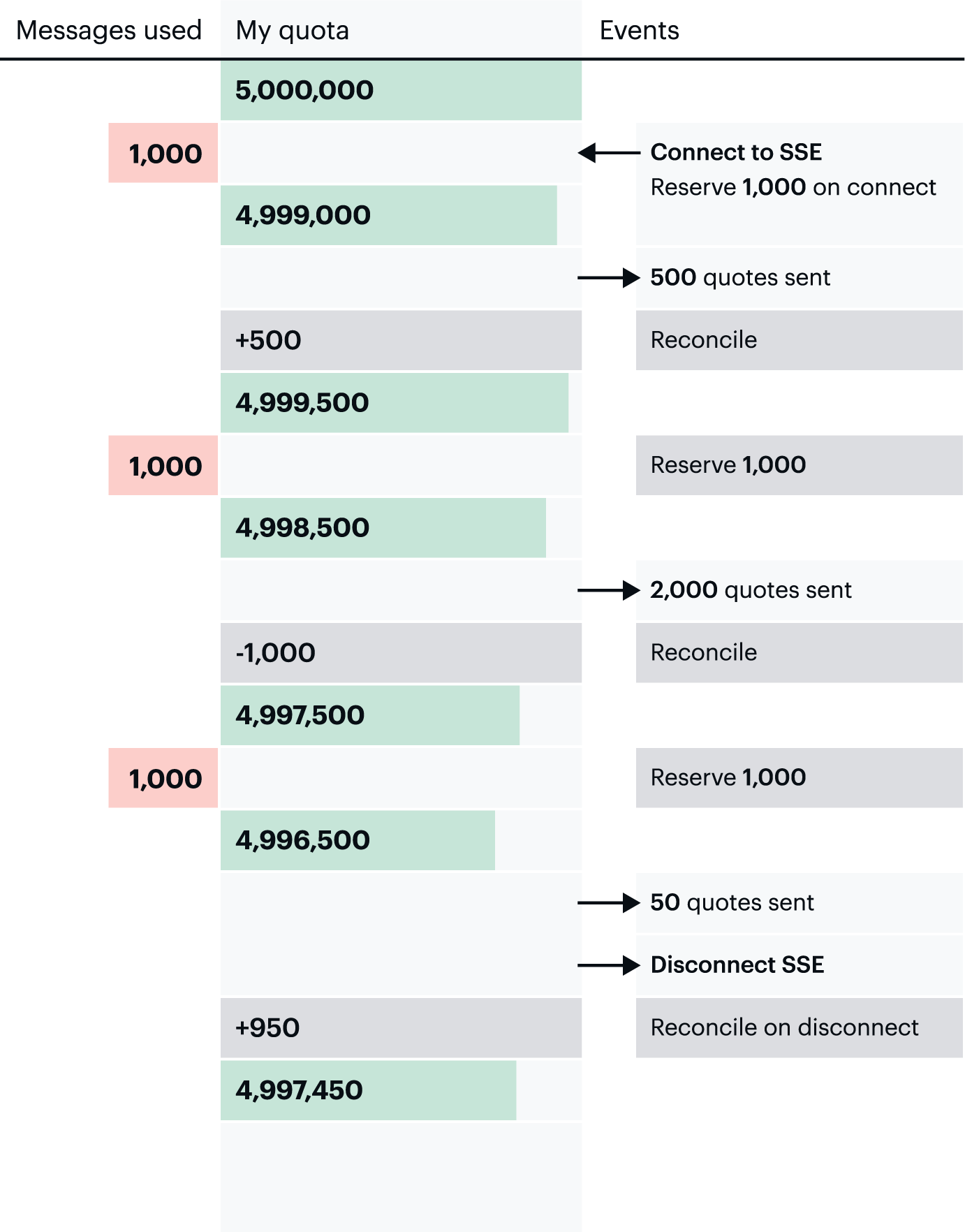

Legacy Plan Credits and SSE Streaming

We use a special "reserve system” for streaming endpoints due to high data rates. This is similar to how a credit card puts a hold on an account and later reconciles the amount.

When you connect to an SSE endpoint, we validate your API token and then attempt to reserve an amount of credits (previously known as messages) from your account. If you have enough credits in your quota, or if you’re on a legacy Launch, Grow, or Scale plan and you have pay-as-you-go credits enabled, we allow data to start streaming.

We keep track of the number of credits streamed to your account during the reserve interval.

Once the reserve interval expires, we reconcile usage. This means we compare the number of credits sent to the number of credits we reserved. For example, if you used 1,200 credits, you used 200 more than we reserved; so we use 200 additional credits from your account. If we only used 100 credits, we return the 900 unused credits back to your account.

After reconciling the credits, we attempt another reserve.

The reserve and reconcile process is seamless and does not impact your data stream. If we attempt to reserve credits and your account does not have enough quota and pay-as-you-go is disabled, then we disconnect the SSE streaming service. You can avoid service disruptions by ensuring you have enough packages purchased in advance, or for legacy plans, by enabling pay-as-you-go credits in the Console.

When you disconnect from an endpoint, we reconcile your credit usage immediately.

Firehose

Legacy Business and Legacy Scale plan users can firehose-stream all symbols (except symbols from DEEP endpoints) by leaving off the symbols parameter.

Prorated Credits

While IEX Cloud monthly subscriptions renew at the start of every calendar month, you can sign up for a paid plan or upgrade at any time. When you upgrade or sign up for a monthly paid plan in the middle of a calendar month, the total cost of your first invoice is prorated.

Correspondingly, for the rest of your first calendar month, your plan will also include a prorated number of credits based on when you signed up in the month.

“prorated_messages” on the Credit Use Page

In the IEX Cloud Console, navigate to Credits → Credit Use. Beneath Credit Use by Endpoint, notice the label prorated_messages. prorated_messages shows you the difference between your regular credit allocation and your prorated credit allocation.

For example, if you sign up on September 15, you will only be invoiced for about half of the standard subscription amount and receive half the number of credits allocated for that subscription plan on a monthly basis. Normal billing and credit allocations will resume at the start of the following month.

Note that annual plans are not prorated. The annual term begins on the day you sign up and ends a full year later. For instance, if you signed up on January 15, 2022, your plan will renew on January 15, 2023.

Support

Please consult the following links for information and support.

Have a question or want to report a problem regarding the IEX Cloud API?

Please email us with the below information:

- Email account associated with your IEX Account

- Date/time of the issue

- What you did

- What you expected to happen

- What actually happened

- Additional relevant information

Disclaimers

- Required: If you display any delayed price data, you must display this disclaimer “15 minute delayed price” near that data.

- Required: If you display

latestVolumefrom the Quote endpoint, you must display this disclaimer “Consolidated Volume in Real-time” near that value. - Required: If you display data from the DEEP endpoints or from the TOPS endpoint, you must display this disclaimer “IEX Market Data Delayed 15 milliseconds” near that data.

- All CTA pricing data and UTP pricing data is delayed at least 15 minutes.

Guides

REST How-To

Making your first REST API call is easy and can be done from your browser.

You will need:

- Your publishable token which is found in the Console.

- The URL for the type of data you would like to request.

REST calls are made up of:

- Base url. Example:

https://cloud.iexapis.com - Version. Example:

beta - Token. All REST requests require a valid token and can be added to a url like

?token=YOUR_TOKEN_HERE

Free IEX Price for Apple

https://cloud.iexapis.com/stable/tops?token=YOUR_TOKEN_HERE&symbols=aapl

Stock Quote for Apple

https://cloud.iexapis.com/stable/stock/aapl/quote?token=YOUR_TOKEN_HERE

Curl Quote for Apple From the Command Line

curl -k 'https://cloud.iexapis.com/stable/stock/aapl/quote?token=YOUR_TOKEN_HERE'

Excel How-To

IEX Cloud Legacy supports Excel and Google Sheets data import methods.

Excel

Excel provides the Webservice function to import data into a cell. We support this functions in the /stock/{symbol}/quote and /stock/{symbol}/stats endpoints, and in the Balance Sheet, Cash Flow, Dividends, Financials, and Income core dataset endpoints:

Example: Pull latest price for Apple

=WEBSERVICE("https://cloud.iexapis.com/v1/stock/aapl/quote/latestPrice?token=YOUR_TOKEN_HERE")

IEX Cloud Legacy provides an example Excel file that can be used to see how the web service function works.

Download it here - the Excel webservice function only works on Excel for Windows.

Please note, the highlighted column for latestUpdate is a formula that converts the Unix timestamp into an Excel date/time. To get this to work you must enter your token in column B1. And make sure to refresh your workbook (CTRL + ALT + F9).

Google Sheets

Google Sheets provides IMPORT functions to populate cells with data.

Example: Pull latest price for Apple

=IMPORTDATA("https://cloud.iexapis.com/v1/stock/aapl/quote/latestPrice?token=YOUR_TOKEN_HERE")

Example: Next earnings report date for Apple

=IMPORTDATA("https://cloud.iexapis.com/v1/stock/aapl/estimates/1/reportDate?token=YOUR_TOKEN_HERE")

CSV Files

You can also return most endpoints in CSV format by using the query parameter format=csv.

https://cloud.iexapis.com/v1/stock/aapl/quote?token=YOUR_TOKEN_HERE&format=csv

Developer Tools and Open Source

Client Libraries

IEX Cloud has a growing set of official and unofficial client libraries, open source apps, and integrations. More information is available on our Developer Community Page.

Official Libraries

<br

Our official libraries are actively maintained by both IEX Cloud and the open source community. If you’re interested in a language not covered here, reach via our community page and/or vote on the corresponding tickets on our unofficial roadmap.

| Name | Language | GitHub | Install |

|---|---|---|---|

| pyEX | Python |  |

|

| iexjs | JavaScript |  |

|

Testing Sandbox Deprecated

IEX Cloud Legacy provides all accounts a free, unlimited use sandbox for testing. Every account will be assigned two test tokens available via the Console. All sandbox endpoints function the same as production, so you will only need to change the base url and token.

We’ve also updated the Usage Report to allow you to view the number of test credits the same way as production credit usage.

How to Use

- The base url is

https://sandbox.iexapis.com - You can also test SSE with

https://sandbox-sse.iexapis.com - Your test token is available on the console by click the “View Test Data” toggle in the nav.

- All tier features are enforced at this time, but you are not limited by the number of calls you can make. You are not charged for test usage.

Test tokens look like Tpk_ and Tsk_

To make a call for test data, use the same url, but pass your test token.

API Usage

Common functionality across all APIs.

Query Parameters

- Parameter values must be comma-delimited when requesting multiple.

- (e.g.,

symbols=SNAP,fbis correct.)

- (e.g.,

- Case does not matter when passing values to a parameter unless specified in the docs.

- (e.g., Both

symbols=fbandsymbols=FBwork.)

- (e.g., Both

- Make sure to URL-encode values.

- (e.g.,

symbols=AIG+encoded issymbols=AIG%2b.)

- (e.g.,

Data Formats

Some endpoints support a format parameter to return data in a format other than the default JSON.

Supported formats

| Format | Content Type | Example |

|---|---|---|

| json | application/json | format=json or by not passing the format parameter. |

| csv | text/csv | format=csv |

| psv | text/plain | format=psv |

Filter Results

Some endpoints support a filter parameter to return a subset of data. Pass a comma-delimited list of response attributes to filter. Response attributes are case-sensitive and are listed in each endpoint reference document’s Response Attributes section.

Example: filter=symbol,volume,lastSalePrice returns only these three specified attributes.

Result Schema

In many cases, you may want to know the type of returned data. For example, you want to build a SQL table from endpoint results and you want to know/verify column types.

Some endpoints support a schema parameter to return just the types of the result set. Simply pass in the schema=true query parameter and the endpoint returns an array of column names and data types from a resulting data record.

Time Series

Time Series Endpoint

Time series is the most common type of data available, and consists of a collection of data points over a period of time. Time series data is indexed by a single date field, and can be retrieved by any portion of time.

To use this endpoint, you’ll first make a free call to get an inventory of available time series data.

HTTP REQUEST

# List all available time series data

GET /time-series

RESPONSE

{

"id": "REPORTED_FINANCIALS",

"description": "Reported financials",

"key": "a valid symbol",

"subkey": "10-K,10-Q",

"schema": {

"type": "object",

"properties": {

"formFiscalYear": {

"type": "number"

},

"formFiscalQuarter": {

"type": "number"

},

"version": {

"type": "string"

},

"periodStart": {

"type": "string"

},

"periodEnd": {

"type": "string"

},

"dateFiled": {

"type": "string"

},

"reportLink": {

"type": "string"

},

"adsh": {

"type": "string"

},

"stat": {

"type": "object"

}

}

},

"weight": 5000,

"created": "2019-06-04 21:32:20",

"lastUpdated": "2019-06-04 21:32:20"

}

A full inventory of time series data is returned by calling /time-series without a data id. The data structure returned is an array of available data sets that includes the data set id, a description of the data set, the data weight, a data schema, date created, and last updated date. The schema defines the minimum data properties for the data set, but note that additional properties can be returned. This is possible when data varies between keys of a given data set.

Each inventory entry may include a key and subkey which describes what can be used for the key or subkey parameter.

Once you find the data set you want, use the id to query the time series data.

HTTP REQUEST

# Get time series data

GET /time-series/{id}/{key?}/{subkey?}

Time series data is queried by a required data set id. For example, “REPORTED_FINANCIALS”. Some time series data sets are broken down further by a data set key. This may commonly be a symbol. For example, REPORTED_FINANCIALS accepts a symbol such as AAPL as a key. Data sets can be even further broken down by sub key. For example, REPORTED_FINANCIALS data set with the key AAPL can have a sub key of 10-Q or 10-K.

Keys and sub keys will be defined in the data set inventory.

The /time-series endpoint supports batch requests.

/time-series batch requests are limited to 12 individual queries (i.e., queries = datasets queried × keys queried). If a batch request exceeds this limit, Apperate reports the error and skips executing the batch request.

Data Weighting (applicable only to legacy price plans)

The time series inventory call is Free

Time series data weight is specified in the inventory call and applied per array item (row) returned.

Data Timing

Varies

Data Schedule

Varies

Data Source(s)

Varies

Notes

Access to each data point will be based on the source Stocks endpoint

Available Methods

GET /time-series

GET /time-series/{id}/{key?}/{subkey}

Examples

/time-series/REPORTED_FINANCIALS/AAPL/time-series/REPORTED_FINANCIALS/AAPL/10-K/time-series/REPORTED_FINANCIALS/AAPL/10-Q?range=1y/time-series/REPORTED_FINANCIALS/AAPL/10-Q?range=next-week&calendar=true/time-series/REPORTED_FINANCIALS/AAPL/10-Q?last=2/time-series/REPORTED_FINANCIALS/AAPL/10-Q?first=3/time-series/REPORTED_FINANCIALS/AAPL/10-Q?from=2018-01-01&to=2019-06-01/time-series/REPORTED_FINANCIALS/AAPL/10-Q?from=2016-01-01&limit=10/time-series/REPORTED_FINANCIALS/AAPL/10-Q?on=2016-01-01/time-series/REPORTED_FINANCIALS/AAPL/10-Q?from=2010-01-01&interval=2&format=csv/time-series/FUNDAMENTALS/AAPL?limit=1&subattribute=fiscalQuarter|3,fiscalYear|2020

Path Parameters

| Parameter | Details |

|---|---|

| id | Required. • ID used to identify a time series dataset. |

| key | Required. • Key used to identify data within a dataset. A common example is a symbol such as AAPL. |

| subkey | Optional. • The optional subkey can used to further refine data for a particular key if available. |

Query Parameters

| Parameter | Type | Details |

|---|---|---|

| range | string | Optional. Returns data for a given range. Supported ranges described below. |

| calendar | boolean | Optional. Boolean. Used in conjunction with range to return data in the future. |

| limit | number | Optional. Limits the number of results returned. Defaults to 1 when no date or range {subkey} is specified |

| subattribute | string | Optional. Allows you to query time series by fields in the result set. All time series data is stored by ID, then key, then subkey. If you want to query by any other field in the data, you can use subattribute. For example, news may be stored as /news/{symbol}/{newsId}, and the result data returns the keys id, symbol, date, sector, hasPaywall, langBy default you can only query by symbol or id. Maybe you want to query all news where the language is English. Your query would be: /time-series/news?subattribute=lang|en The syntax is subattribute={keyName1}|{value1},{keyName2}|{value2} Both the key name and the value are case sensitive. A pipe symbol ( |) is used to represent “equal to”, and a tilde symbol (~) is used to represent “not equal to”. |

| dateField | string | Optional. All time series data is stored by a single date field, and that field is used for any range or date parameters. You may want to query time series data by a different date in the result set. To change the date field used by range queries, pass the case sensitive field name with this parameter. For example, corporate buy back data may be stored by announce date, but also contains an end date which you’d rather query by. To query by end date you would use dateField=endDate&range=last-week |

| from | string | Optional. Returns data on or after the given from date. Format YYYY-MM-DD |

| to | string | Optional. Returns data on or before the given to date. Format YYYY-MM-DD |

| on | string | Optional. Returns data on the given date. Format YYYY-MM-DD |

| last | number | Optional. Returns the latest n number of records in the series |

| next | number | Optional. Returns the next n number of records in the series |

| first | number | Optional. Returns the first n number of records in the series |

| filter | string | Optional. The standard filter parameter. Filters return data to the specified comma delimited list of keys (case-sensitive) |

| format | string | Optional. The standard format parameter. Returns data as JSON by default. See the data format section for supported types. |

| sort | string | Optional. Specify the order of results, either ASC or DESC. Historical queries, including queries that use last, will default to descending date order (e.g. first record returned is most recent record). Forward looking queries, including queries that use first or specify calendar, will default to ascending date order (e.g. first record returned is nearest record in the future or from the start). |

| interval | number | Optional. Return every nth record in the result |

Supported Ranges

| Parameter | Details |

|---|---|

| today | Returns data for today |

| yesterday | Returns data for yesterday |

| ytd | Returns data for the current year |

| last-week | Returns data for Sunday-Saturday last week |

| last-month | Returns data for the last month |

| last-quarter | Returns data for the last quarter |

| d | Use the short hand d to return a number of days. Example: 2d returns 2 days. If calendar=true, data is returned from today forward. |

| w | Use the short hand w to return a number of weeks. Example: 2w returns 2 weeks. If calendar=true, data is returned from today forward. |

| m | Use the short hand m to return a number of months. Example: 2m returns 2 months. If calendar=true, data is returned from today forward. |

| q | Use the short hand q to return a number of quarters. Example: 2q returns 2 quarters. If calendar=true, data is returned from today forward. |

| y | Use the short hand y to return a number of years. Example: 2y returns 2 years. If calendar=true, data is returned from today forward. |

| tomorrow | Calendar data for tomorrow. Requires calendar=true |

| this-week | Calendar data for Sunday-Saturday this week. Requires calendar=true |

| this-month | Calendar data for current month. Requires calendar=true |

| this-quarter | Calendar data for current quarter. Requires calendar=true |

| next-week | Calendar data for Sunday-Saturday next week. Requires calendar=true |

| next-month | Calendar data for next month. Requires calendar=true |

| next-quarter | Calendar data for next quarter. Requires calendar=true |

| specific quarter | Use the short hand Q[1-4]YYYY to return a specific quarter for a given year. Example: Q22020 returns from January 1, 2020 to March 31, 2020. |

| specific half | Use the short hand H[1-2]YYYY to return a specific half for a given year. Example: H12020 returns from January 1, 2020 to June 30, 2020. |

| specific year | Use the short hand YYYY to return a specific half for a given year. Example: 2020 returns from January 1, 2020 to December 31, 2020. |

Response Attributes

Time series call returns an array of objects. The data returned varies by dataset ID, but each will contain common attributes.

| Name | Type | Description |

|---|---|---|

| id | string | The dataset ID |

| key | string | The requested dataset key |

| subkey | string | The requested dataset subkey |

| date | number | The time series date as milliseconds since Epoch |

| updated | number | The time data was last updated as milliseconds since Epoch |

Time series inventory call returns:

| Name | Type | Description |

|---|---|---|

| id | string | Dataset ID |

| description | string | Description of the dataset |

| key | string | Dataset key |

| subkey | string | Dataset subkey |

| schema | object | Data weight to call the individual data point in number of credits. |

| weight | number | Data weight to call the time series in number of credits per array item (row) returned. |

| created | string | ISO 8601 formatted date time the time series dataset was created. |

| lastUpdated | string | ISO 8601 formatted date time the time series dataset was last updated. |

Time Series Metadata BETA

Time-Series presents us a with a powerful query interface on top of our data, while the inventory calls allow us to know the shape of the data contained therein. But sometimes we want to answer questions like “What are all the possible values of key for the time series id FUNDAMENTALS?” or “What time series ids contain data on AAPL?”

For these, we have time series metadata.

HTTP REQUEST

GET /metadata/time-series/{id}/{key?}/{subkey?}

RESPONSE

// metadata/time-series

[

{

"id":"ADVANCED_BONUS",

"value":"ADVANCED_BONUS",

"numberOfRecords":5149

},

{

"id":"ADVANCED_DISTRIBUTION",

"value":"ADVANCED_DISTRIBUTION",

"numberOfRecords":1093

},

// ...

]

// metadata/time-series/FUNDAMENTALS

[

{

"key":"A",

"value":"A",

"numberOfRecords":127

},

{

"key":"AA",

"value":"AA",

"numberOfRecords":41

},

{

"key":"AAIC",

"value":"AAIC",

"numberOfRecords":108

},

// ...

// metadata/time-series/*/AAPL

[

{

"id":"ADVANCED_BONUS",

"value":"ADVANCED_BONUS",

"numberOfRecords": 3

},

{

"id":"ADVANCED_DIVIDENDS",

"value":"ADVANCED_DIVIDENDS",

"numberOfRecords":36

},

{

"id":"ADVANCED_SPLITS",

"value":"ADVANCED_SPLITS",

"numberOfRecords": 1

},

// ...

]

Data Weighting (applicable only to legacy price plans)

The time series metadata call is Free.

Data Timing

Varies

Data Schedule

Varies

Data Source(s)

Varies

Available Methods

GET /metadata/time-series/{id}/{key?}/{subkey}

Examples

Path Parameters

| Parameter | Details |

|---|---|

| id | ID used to identify a time series dataset. Leave as * for all satisfying records |

| key | Key used to identify data within a dataset. A common example is a symbol such as AAPL. |

| subkey | Optional. • The optional subkey can used to further refine data for a particular key if available. |

Calendar

Using the time series calendar parameter, you can use short-hand codes to pull future event data such as tomorrow, next-week, this-month, next-month, and more.

Subset of time series parameters used for calendar

| Parameter | Details |

|---|---|

| range | Optional. • Returns data for a given range. Supported ranges described below. |

| calendar | Optional. • boolean. Used in conjunction with range to return data in the future. |

| Plus all supported time series parameters |

Supported calendar ranges

| Parameter | Details |

|---|---|

| d | Use the short hand d to return a number of days. Example: 2d returns 2 days. If calendar=true, data is returned from today forward. |

| w | Use the short hand w to return a number of weeks. Example: 2w returns 2 weeks. If calendar=true, data is returned from today forward. |

| m | Use the short hand m to return a number of months. Example: 2m returns 2 months. If calendar=true, data is returned from today forward. |

| q | Use the short hand q to return a number of quarters. Example: 2q returns 2 quarters. If calendar=true, data is returned from today forward. |

| y | Use the short hand y to return a number of years. Example: 2y returns 2 years. If calendar=true, data is returned from today forward. |

| tomorrow | Calendar data for tomorrow. Requires calendar=true |

| this-week | Calendar data for Sunday-Saturday this week. Requires calendar=true |

| this-month | Calendar data for current month. Requires calendar=true |

| this-quarter | Calendar data for current quarter. Requires calendar=true |

| next-week | Calendar data for Sunday-Saturday next week. Requires calendar=true |

| next-month | Calendar data for next month. Requires calendar=true |

| next-quarter | Calendar data for next quarter. Requires calendar=true |

Points and Files

Data Points let you access individual data values, while Files lets you conveniently access pregenerated files.

Data Points

Data points are available per symbol and return individual plain text values. Retrieving individual data points is useful for Excel and Google Sheet users, and applications where a single, lightweight value is needed. Some endpoints provide update times; this allows you to call an endpoint only once it has new data.

To use this endpoint, first make a free call to list all available data points for your desired symbol, which can be a security or data category.

HTTP REQUEST

# List available data keys

GET /data-points/{symbol}

RESPONSE

[

{

"key": "BETA",

"weight": 1,

"description": "",

"lastUpdated": "2022-07-29T09:46:08+00:00"

},

{

"key": "ACCOUNTSPAYABLE",

"weight": 3000,

"description": "Balance Sheet: accountsPayable",

"lastUpdated": "2022-05-09T12:47:55+00:00"

},

{

"key": "CAPITALSURPLUS",

"weight": 3000,

"description": "Balance Sheet: capitalSurplus",

"lastUpdated": "2022-05-09T12:47:55+00:00"

}

]

Once you find the data point you want, use the key to fetch the individual data point value.

HTTP REQUEST

# Get a data point

GET /data-points/{symbol}/{key}

Data Weighting (applicable only to legacy price plans)

List available data keys Free

Get a data point: The weight specified in the data list.

Data Timing

Varies

Data Schedule

Varies

Data Source(s)

Varies

Notes

Access to each data point is based on the source Stocks endpoint.

Available Methods

GET /data-points/{symbol}GET /data-points/{symbol}/{key}

Examples

Response Attributes

Data point calls return a single plain text value.

Available data keys calls return:

| Name | Type | Description |

|---|---|---|

| key | string | Data key used to call a specific data point |

| weight | number | Data weight to call the individual data point in number of credits |

| description | string | Description of the data point |

| lastUpdated | string | ISO 8601 formatted date time the data point was last updated |

Files

The Files API allows users to download bulk data files, PDFs, etc.

Lookup Available Files

HTTP REQUEST

# List all available file types

GET /files

RESPONSE

[

{

"id": "VALUENGINE_REPORT",

"metadata": {

"weight": "PREMIUM_VALUENGINE_REPORT",

"bySymbol": true,

"byDate": true,

"numberOfDownloads": 3,

"source": "ValueEngine",

"contentType": "text/pdf",

"extension": "pdf",

"tags": [ ],

"categories": [ ]

},

"lastUpdated": "2020-03-20T15:15:03+00:00"

},

]

Lookup Available Symbols and/or Dates for File Types

For files that have bySymbol = true or byDate = true, this call will show what symbols and dates are available.

HTTP REQUEST

# List all available file types

GET /files/info/:id

RESPONSE

{

"symbols": [],

"dates": []

}

Download a file

This call returns an HTTP redirect to a one time secure URL. The URL expires after 1 minute.

HTTP REQUEST

# List all available file types

GET /files/download/:id?symbol={symbol}&date={date}

HTTP Redirect response

If the file schema specifies bySymbol = true, then pass a {symbol} query parameter.

If the file schema specifies byDate = true, then pass a {date} query parameter the format "YYYYMMDD".

Batch Requests

HTTP REQUEST

GET /stock/{symbol}/batch

RESPONSE

// .../symbol

{

"quote": {...},

"news": [...],

"chart": [...]

}

// .../market

{

"AAPL" : {

"quote": {...},

"news": [...],

"chart": [...]

},

"FB" : {

"quote": {...},

"news": [...],

"chart": [...]

},

// { ... }

}

Note: If a batch query exceeds its limit, Apperate reports the error and skips executing the batch query. Please see the endpoint’s documentation for information on its limits.

Data Weighting (applicable only to legacy price plans)

Based on each type of call

Examples

/stock/aapl/batch?types=quote,news,chart&range=1m&last=10/stock/market/batch?symbols=aapl,fb,tsla&types=quote,news,chart&range=1m&last=5

Path Parameters

| Parameter | Description |

|---|---|

| symbol | Use market to query multiple symbols (i.e. .../market/batch?...) |

Query Parameters

| Option | Details |

|---|---|

| types | Required. Comma delimited list of endpoints to call. The names must match the individual endpoint names. The cross product count of types and symbols must not exceed 2000. Limit: symbols * types <= 2000 |

| symbols | Optional. Comma delimited list of symbols. The cross product count of types and symbols must not exceed 2000. This parameter is used only if market option is used.Limit: symbols * types <= 2000 |

| range | Optional. Used to specify a chart range if chart is used in types parameter. |

| * | Optional. Parameters that are sent to individual endpoints can be specified in batch calls and are applied to each supporting endpoint. For example, last can be used for the news endpoint to specify the number of articles |

Response Attributes

Responses vary based on types requested. Refer to each endpoint for details.

Streaming Data

SSE Streaming

NOTE: Only included with paid subscription plans

We support Server-sent Events (SSE Streaming) for streaming data as an alternative to WebSockets. You will need to decide whether SSE streaming is more efficient for your workflow than REST calls. In many cases streaming is more efficient since you will only receive the latest available data. If you need to control how often you receive updates, then you may use REST to set a timed interval.

Snapshots

When you connect to an SSE endpoint, you should receive a snapshot of the latest message, then updates as they are available. You can disable this feature by passing a url parameter of nosnapshot=true.

You can also specify a starting point for a snapshot by passing a url parameter of snapshotAsOf=EPOCH_TIMESTAMP where the value is in milliseconds since Epoch.

Curl Example

curl --header 'Accept: text/event-stream' https://cloud-sse.iexapis.com/stable/stocksUS\?symbols\=spy\&token\=YOUR_TOKEN

Curl Firehose Example

curl --header 'Accept: text/event-stream' https://cloud-sse.iexapis.com/stable/stocksUS\?token\=YOUR_TOKEN

Curl Example (Not authorized by UTP)

curl --header 'Accept: text/event-stream' https://cloud-sse.iexapis.com/stable/stocksUSNoUTP\?symbols\=spy\&token\=YOUR_TOKEN

Curl Firehose Example (Not authorized by UTP)

curl --header 'Accept: text/event-stream' https://cloud-sse.iexapis.com/stable/stocksUSNoUTP\?token\=YOUR_TOKEN

How Credits Are Counted

We use a reserve system for streaming endpoints due to high data rates. This is similar to how a credit card puts a hold on an account and reconciles the amount at a later time.

When you connect to an SSE endpoint, we will validate your API token, then attempt to reserve an amount of credits from your account. For example, 1000 credits.

If you have enough credits in your quota (if you have pay-as-you-go enabled on our legacy plans), we will allow data to start streaming.

We keep track of the number of messages streamed to your account during our reserve interval.

Once our reserve interval expires, we will reconcile usage. This means we will compare how many credits worth of messages were sent versus the number of credits we reserved. For example, if we delivered 1200 credits worth of messages, you would have used 200 more than we reserved, so we will apply 200 additional credits to your account. If we only delivered 100 credits worth of messages, we would add the 900 unused credits back to your account.

After we reconcile the credits, we will attempt another reserve.